What The Heck is a “Hedge Fund” Anyway?

I’ve made an observation over the past couple of years that has peaked my interest. Large Hedge funds and Wall Street types buying up single family homes. Now, I’m by no means a seasoned investor in the stock market but I’d like to think I know a thing or two about the benefits of home ownership along with investing in real estate. So I dug a bit deeper. Why is Wall Street playing around with single family homes?

Home ownership has long been a cornerstone of the American Dream, but recent trends show that hedge funds and institutional investors are buying up a large portion of these homes. If you’re paying attention to the news you’ll hear about company’s like “Blackstone”, “JPMorgan” and even “Zillow” buying up homes in various Metropolitan markets around the country. Places like Atlanta, Phoenix and Los Angeles. To the best of my knowledge they haven’t trickled down to the smaller markets yet, but only time will tell on that one.

I thought this was a fairly recent trend since it was getting all kinds of media attention, but after reading more into it I found out that Institutions have been doing this in some capacity since the 1960s. Usually this was more focused on larger commercial developments like hotels, apartment complexes, shopping malls, you get the picture. Wall Street started investing in single-family rental homes in the mid-2000s, but really picked up steam right at and shortly after the 2008 housing crash. They saw an opportunity to buy an “Asset” that, generally speaking, appreciates in value and throws off cash flow. Much like a bond or dividend paying stock. But, with the benefit of being a tangible asset that’s also a great hedge against inflation.

What does this mean for you as a first time home buyer?

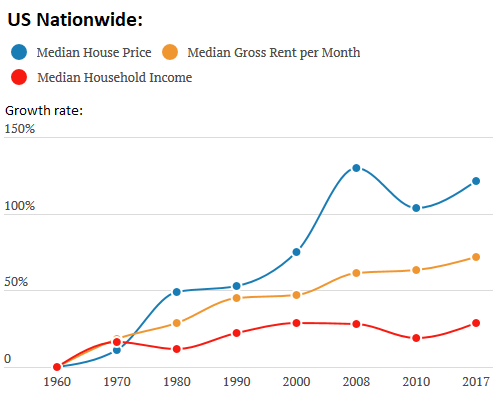

To help unpack what this all means I think it helps to look at some stats on home ownership costs, rental costs and median income rates over the last 70 years. I think this helps to illustrate the motivations of the smart money folks trying to capitalize on home ownership.

Just in case you’re not a graph nerd like I am let me break it down for you. Based on Census data going back to 1960 for median household incomes, median gross rents per month, and median house prices, all adjusted for inflation, it shows that nationally, incomes since 1960 have risen just 29%, while rents have risen 72%, and house prices have soared 121%.

Long story short: your parents and grand parents probably had an easier time affording a home than you probably will. Now that’s not to say they didn’t have their own challenges. Depending on when they bought they may have paid as much as 18% interest rate on their mortgage. All the sudden that high 5% to low 6% rate doesn’t seem that bad.

Now let me just say I don’t have a crystal ball. I can’t predict the future. What I can do is take a look at the data and try to come to some sort of conclusion. If you take a look at the blue line on that graph you can see that it’s had a pretty steady upward pattern. Even if you take out the aggressive rise and fall between 2000 and 2010 (the housing crash of 08) it still shows a a pretty steady increase. That’s home values.

Furthermore, the yellow line that represents the average rental rate also shows a pretty steady increase. The red one which represents wages is relatively flat compared to the other 2…

Based on what I see in this graph coupled with the actions of all these institutional investors, I’d be willing to wager that Wall Street is betting on home affordability being out of reach for a lot of Americans given a long enough time frame and the “Status Quo” not changing. I believe they want you to be a renter for life. A renter nation. As someone that takes great pride in helping people achieve their dreams of home ownership, this is a sobering realization to come to. This isn’t new information though and I’m certainly not the only person to draw a conclusion like this.

Putting the “Wind Back In Your Sails”

If I haven’t dashed your dreams of home ownership yet, stay with me! This is where we stick it to the man!! Just because it’s pricier to buy a home now than in the past doesn’t mean you can’t do it! There are all kinds of creative ways to get you into your first home.

Low down payment options

As a first time home buyer it’s likely that the biggest problem you’ll have owning a home is the down payment. There’s a lot people out there that think you need to have 20% down to buy a home for you to live in. That simply isn’t true. The Federal Housing Administration or FHA will do loans for as little as 3.5% down. Even if you don’t have great credit!

If you’re ok with living a bit out out of town you could also qualify for a 0% down USDA loan. Think small town America where you know everyone. I grew up in a small town and wouldn’t change a thing about my up bringing.

If you served in the Military you qualify for a VA loan which is also a 0% down loan. If that’s you, Thank you for your service!

Even the standard conventional loan you can do as low as 5% down. There are also low income grants available to you depending on your income level. This is by no means a comprehensive list of all the financing options available to you, and frankly, that topic deserves its own blog post (I think I just came up with my next article lol…)

House Hacking

If you’re a reader or listener to “Bigger Pockets”, a real estate investing podcast/website/community, than you’ve heard this word. For the uninitiated, “House Hacking” is a creative way to help offset the cost of your home. This is a method I’ve used in the past and always encourage any of my clients to try that are willing to think outside the box.

Probably the most common way to do this is to buy a live in duplex. A Duplex is a 2 unit housing structure situated on a single parcel of land. They’re very similar to townhomes but differs in that it has multiple attached units on one piece of property. Unlike a townhome which has 1 unit on one parcel of ground. It’s a pretty simple strategy really. Live in one unit and rent out the other unit. Depending on how good of a deal you get you could potentially live in the unit for free. Couple this method with the use of Airbnb and/or roommates and it’s not outside the question to actually get paid to live in your house.

What’s really cool about this strategy is you can use an FHA loan to get into a duplex house. As a matter of fact you can even buy up to a 4 unit apartment building with this 3.5% down financing strategy. The only kicker is you MUST occupy the property for a minimum of 1 year.

Buying a “Fixer Upper” (Definitely not this one though…)

If you’re a bit handy (or don’t mind watching youtube on how to do home remodel projects) than this may be a great way for you to score a good deal. This can potentially get you a house in a neighborhood you might not have been able to afford otherwise. This is a method I’ve personally used to great success. As a matter of fact, I don’t think I’ve ever bought a “nice” house. My wife tells me the next one we buy has to be a nice one though lol… The uglier the better in my opinion.

Now there are limits to this. As a first time home buyer I wouldn’t recommend buying a home with extensive foundation problems. That can get very expensive very quickly. Try to find that ugly duckling with good bones. At the end of the day there is always a price where any home, no matter how bad it is, makes sense. The real question is whether or not you can get it bought at a price that makes sense. As a first time buyer that’s why it’s so important to align yourself with a knowledgeable Realtor. Which segues really nicely into my next point….

Find a Knowledgeable Realtor

Now I might be a bit biased but I firmly believe that working with a knowledgeable Realtor is crucial. ESPECIALLY if this is your first home purchase. All of these strategies I listed above are great. I highly recommend them, but if you end up buying the wrong property or don’t understand the ins and outs of these strategies you could end up getting burned.

The last thing you want is to over pay for a property, over estimate the rents a property can command or under estimate the cost of a remodel. That’s why its critical to work with someone with experience in all these areas. Especially if you need to implement these strategies to make buying a home within your grasp. They will act as your guide to help you along in your adventure of home ownership.

Follow the Smart Money

I can’t say for sure that all the doom and gloom I talked about above will come to pass in our lifetime. I certainly hope that it doesn’t. I firmly believe in the idea of the “American Dream” of home ownership. If you want to own a home, there is a way to make it happen no matter your circumstances. If buying a home is something you’ve always thought is out of reach, I hope this article has armed you with helpful insight and outside the box methods to make that within reach for you. Wall Street seems to think it’s a good idea, why shouldn’t you?

As always, if any of the ideas and strategies in this post have piqued your interest, don’t hesitate to reach out to either of us.

-Cody & Jos-

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link