Selling For Sale By Owner? Some Things To Consider

Way back in 2015 I was a first time home flipper, full of ambition with an “I know what I’m doing” attitude. I watched “Flip or Flop” a time or two… How hard could it be?? My business partner and I were putting the finishing touches on a house we had just got done remodeling. Our plan was to sell it For Sale By Owner to save money. We were in uncharted territory when it came to marketing a house. Frankly we didn’t have a clue what we were doing. We figured we would throw some pictures up on Zillow using our potato phone (camera phones sure have improved since then) and the offers would just come pouring in!!

They didn’t. We overpriced our listing, took awful photos, weren’t properly marketing the property and we were emotionally attached since this was our first flip. Who cares what the comparable sales say right? Fast forward about 2 months and we enlisted the help of a Realtor. The property ended up selling right at what the comps were showing, in relatively short order.

Fast forward to present day and I have since gotten a “Baptism by Fire” education on exactly what it takes to sell a home. Having been in the business since late 2016, I’ve been apart of the sale of well over 100 homes. I also see on a daily basis other for sale by owners making the exact same mistakes I was making back in 2015.

Buckle Up! We’re going to school

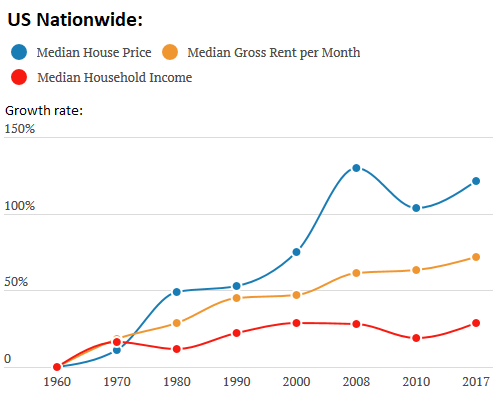

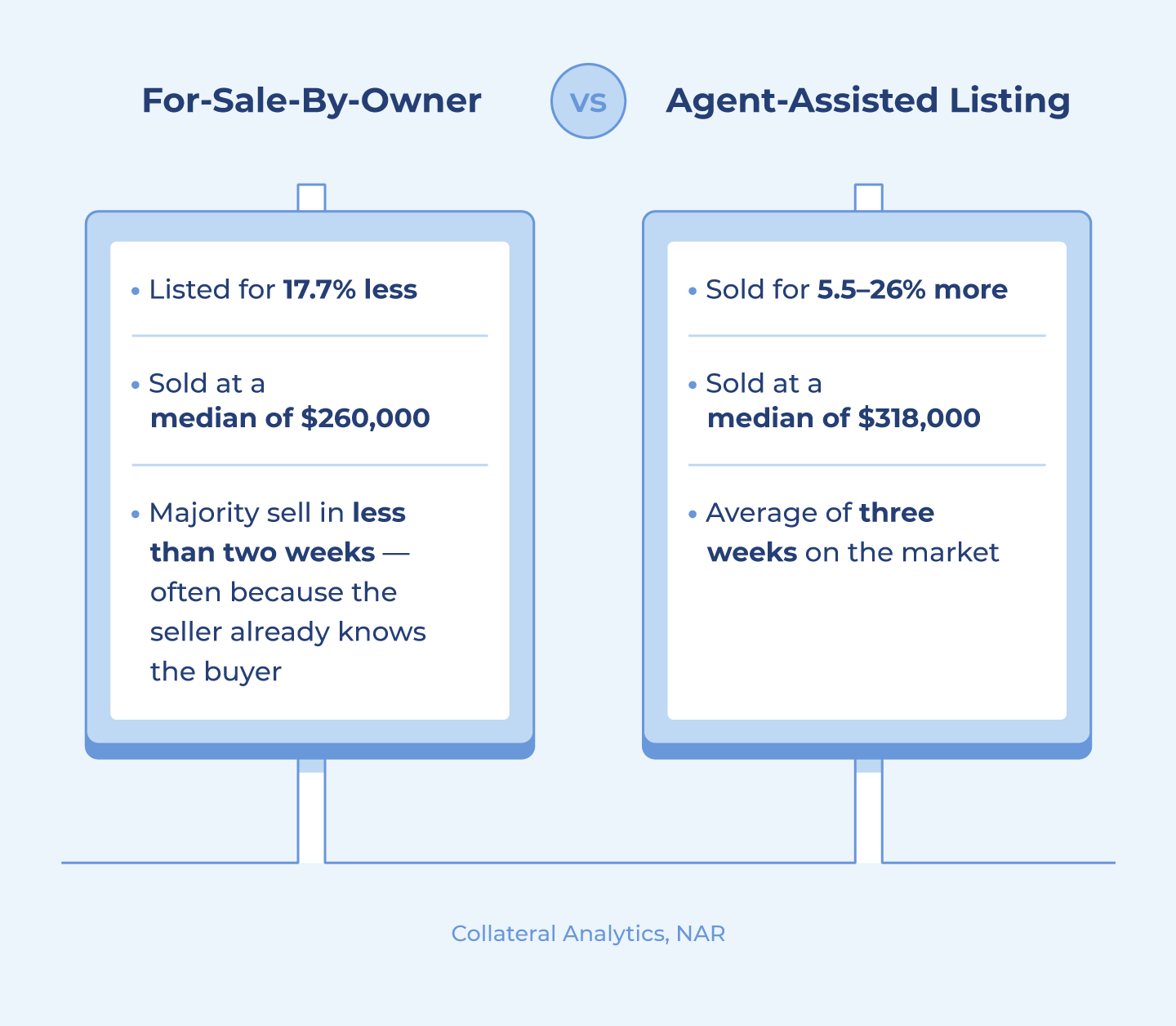

Now I don’t want to say it’s impossible to sell a home without the assistance of a Realtor. But the odds are stacked against you and it’s likely gonna for sell for less… At least that’s what the data shows.

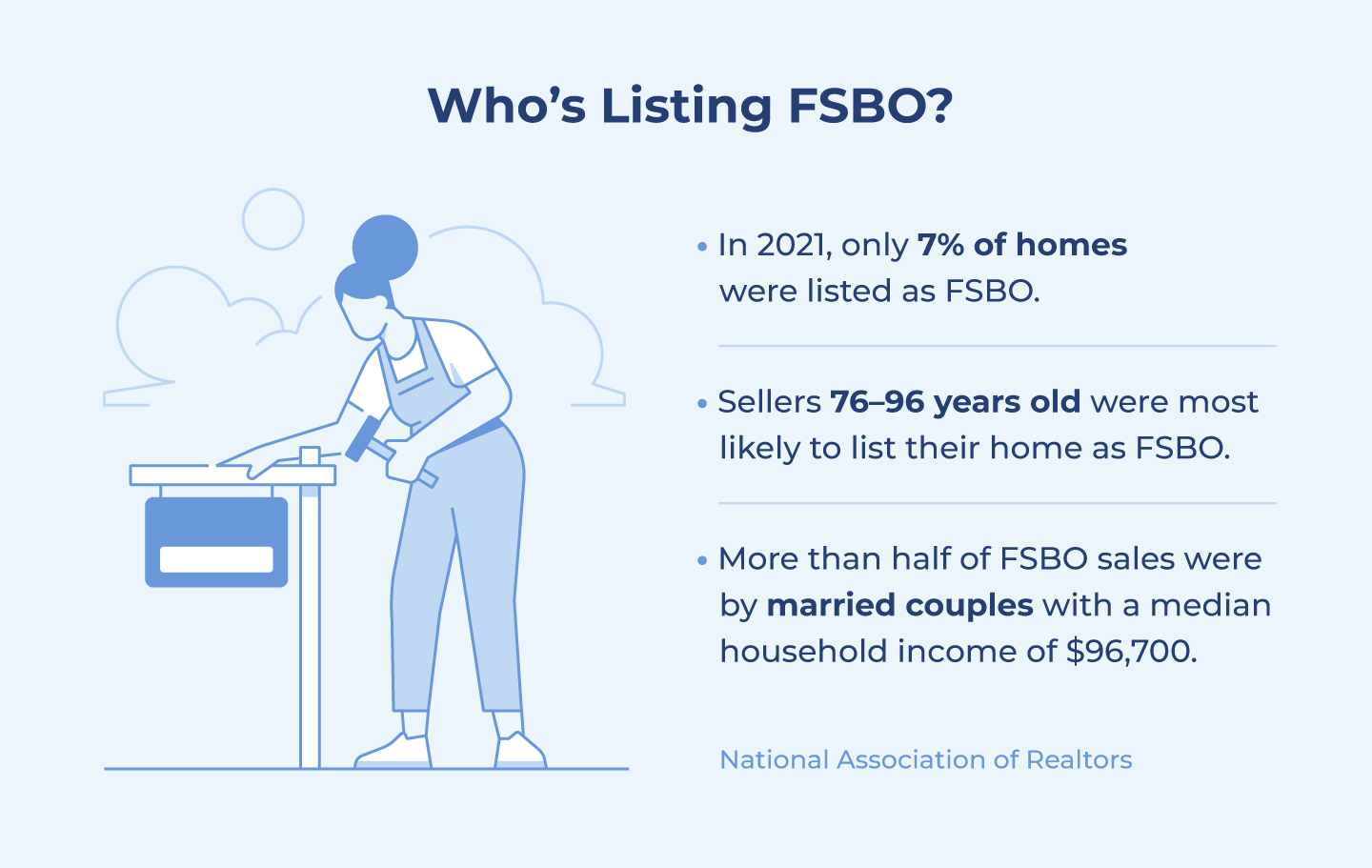

According to the National Association of Realtors 2021 analysis of all FSBO vs Realtor sales, there is a stark contrast between what a for sale by owner listing vs a Realtor listing will sell for. The average sales price for all FSBO sales is 260k. The average sales price for a Realtor assisted sale is 318k. I will concede that for sale by owner on average did sell faster. For that kind of a bargain I can see why. To add some context, for sale by owner listings made up 7% of all real estate sales in 2021, down from their high of 15% back in the early 1980s.

Now I think there are a lot of reasons for this. Some I can back up with stats, and some anecdotal evidence that I’ve seen though out the years. Lets get into it shall we?

FSBO’s Get Less Exposure

This is probably THE most important factor when it comes to selling a home. Realtors have a pretty big leg up against FSBO’s on this one. Whenever we list a property on our Multiple Listing Service (MLS for short) our listing automatically gets input onto literally thousands of websites. If it’s a website where you look at real estate, you will find it there. A FSBO would have to manually input all those listings into each website individually to match the exposure we offer.

On top of that, a good realtor is going to take the time to put together a comprehensive marketing strategy. Some examples of this include:

- Professional Photography (this is beyond important)

- Videography

- Staging

- Direct mail marketing campaign

- Social media marketing campaign

- Agent, Office and Client open houses

- Word of mouth (we’re in the business and probably know a buyer or 2 for your place)

And honestly so much more than that. Marketing a listing deserves it’s own blog post! I guess I know what one of my future articles is going to look like…

You’re typically priced wrong

I keep a pretty close eye on the For Sale by Owner market for 2 reasons. The first is for my buyers. This is a pool of inventory that a lot of agents don’t utilize. This is a good thing for my clients and I’d be doing them a disservice if I wasn’t. Some of my first time buyers are having a hard time competing with the agent listed properties and the multiple offers they typically receive. Just last week we were able to get one of my buyers under contract on a FSBO listing under 150k while getting money back at closing at a price under it’s market value. Ask any Realtor worth their salt and they’d probably tell you that’s not happening on a correctly priced and marketed agent listed property in this market.

The 2nd reason I keep a close eye on the for sale by owner market is for future business. Full transparency, I’m trying to help you and usually you’re making the same mistakes I was making back during my first flip. You’re usually over priced and I completely understand why as well. “It’s my house it has to be worth more.” Typically the FSBO listings that sit on the market longest are the properties that are over priced. Nine times out of ten these properties are listed with agents in about a month to 6 weeks. I’m not the only one calling you. The underpriced homes will typically sell in short order. Kind of gives credence to the FSBO stats I listed above. Be sure not to trust online home value calculators. They can definitely lead you astray. For more info on that, read my article here.

Some Realtors won’t show your listing

I’m going to say the quiet part out loud. Most Realtors don’t like working with FSBO’s. The problem is they’re unsure if you as a FSBO is willing to pay them to bring you a buyer. If you’re still on the fence about using a Realtor, you probably think this is a good thing. I understand why you would. Why pay a pesky Realtor when you can save money on the commission. “I can find my own buyer”. Here’s something you probably haven’t considered…

As a whole, the Real Estate sales industry has done a very good job of educating the general public that working with a Realtor to buy a home costs a buyer very little, and under certain circumstance, nothing at all. It’s an easy sales proposition. Work with a Realtor and they will watch your back when buying a home. It costs very little. This is especially true for first time home buyers. Having never been through the sales process they’re usually going to want someone to cross all the T’s and dot all the I’s so to speak. As a buyers agent we get paid from the commission that’s pre-negotiated from the Listing agent’s commission structure.

At the very least, if you insist on selling “For Sale by Owner” include some language in your listing description stating that you cooperate with buyer’s agents. Some of the bolder agents will approach you. Something to think about though. You will be paying an agent (likely a skilled one) to negotiate against you. If you’re willing to go that far, you may as well pay an agent to represent your best interest. Statistically speaking it’s very likely you’ll end up netting more in the long run.

Story time

A few years back I was helping a client that was previously trying to sell their home for sale by owner. They were in the process of building a new home and needed the proceeds from the sale of their current home to close on the new one. They hadn’t received an offer and had little traffic on their place. I took over the listing utilizing the marketing strategies I mentioned above and started to get traffic into the home. (Actual house pictured below.)

My client had a ring door bell and this was before they had mass adoption in our market. My client sent me the video of what the buyers agent had discussed with their buyer. I’m paraphrasing a bit but it went something like this: Agent “Did you like the home”? Client “I sure did, it’s a perfect fit for what we need.” Agent “Excellent! I’m glad you like it. I actually saw this when it was a for sale by owner but I wasn’t sure if they cooperated with agents. I’m glad it got listed because when I saw it I knew this was the perfect place for you!”

Later that evening we received a great offer from that agent and went under contract. My client was very upset knowing that at least one agent saw this and refused to show it when it was a FSBO. He got over it once he moved into his new house though…

You’re waiting for an unrepresented buyer

Despite our industries attempts at educating the buyer pool, there are still a small percentage of buyers that work without a Realtor. These are usually savvy investor types in my experience. There is a very specific reason they don’t work with Realtors. They’re looking for a deal. Most Realtors work in retail priced real estate. They’re entire niche is finding homes that aren’t properly marketed and lingering for sale. Then they will come in with a low ball offer in an attempt to scoop up a deal.

If you’re holding out hope for that one perfect buyer that’s unrepresented willing to pay full asking price, you might be waiting for a while. I’m not saying it can’t be done, it’s just a lot less likely. Particularly if you’re selling in the 300k and under price point in our market. The current market we’re in is all about speed. The longer your listing sits, the less likely it will sell for market value based solely on buyers perception. “Why has this been sitting for so long? Is something wrong with it?”

We handle it all from “Keys in our hands” to “Check in your hands”

There are a LOT of things that need to go right in order for a home to sell at it’s maximum value. If all those things don’t line up perfectly, it will typically result in a lower sale price, or no sale at all. We’re trained specifically to facilitate a sale, recognize any potential pitfalls along the way and mitigate those pitfalls. Some of those we’ve learned from our colleagues in the business and others we’ve learned through the school of hard knocks. Unless you are a sophisticated investor with dozens of sales under your belt, it’s likely you won’t have the same experience that we have as Realtors working in the business every day.

In summary – Yes, you can sell your house on your own, but it’s highly likely we will end up netting you more money in the long run. Unless your last name is Bezos or Musk, it’s likely that the extra money will help make a difference in your life. I know you were just trying to save money, but you will make more with us.

-Cody & Jos-

Renovations To Consider For Increasing Your Home’s Value

Every time I walk through a house I’m always looking at ways to maximize the value of the home. It’s just something that’s engrained in me. I can’t help myself. I cut my teeth in the real estate world by doing renovations to beat up rentals and doing house flips. That eventually transitioned into being a short term rental operator and being a real estate broker. I guess those skills have a bit of utility on my current path.

The type or scope of the renovations you’re going to do should depend ALOT on what your goals are. If you’re planning on sticking around for the long term, I say go wild! I don’t personally recommend painting your cabinets salmon or going with turquoise countertops or anything like that. But the longer you’re sticking around the more likely you are to recoup your investment on the remodel in the form of equity.

Time To Get Your Home Photoshoot Ready

If you’re planning on doing a spruce up on your home for the purpose of resale, I highly recommend you keep the design theme neutral. Trends come and go. Those “Golden Oak” cabinets that were so cool in the 90’s make your house look pretty dated now. You can be a little brave with your design, but not too brave!

Another thing you need to take into account is what the end value of you home is going to be worth and what your neighborhood will support for that value. That last thing you want to do is waste money on renovations that aren’t going to pay you back. You probably don’t need $75 sq ft Quartz countertops in a neighborhood where the highest comp is 175k. Laminate countertops will be fine. If you’re having trouble figuring out what your renovated value should be, give your friendly neighborhood realtor a call. Don’t trust the online value calculators like Zillow’s “zestimate”. If you want some ammo on why those can be WAY off – READ MY ARTICLE ABOUT ZILLOW’S ZESTIMATE.

FULL DISCLAIMER – I am not an interior designer. I’m just a guy that sells real estate and pays attention to what sells and what doesn’t. With that out of the way, lets get into it. I’ll try to keep this in order of least expensive to most expensive.

Clean and De-clutter

This is such low hanging fruit that I almost didn’t want to include this on the list. You can hardly call this home renovations, but it unlocks otherwise hidden value. I see listings all the time where owners don’t take the time to do this. This is a requirement, not a recommendation. If you’re working with a Realtor and they don’t mind listing a dirty home, that should give you pause. It costs you almost nothing but your time. If your time is limited, hire a cleaner. Seriously. It’s that important.

Paint and Update Fixtures

This has such a good “bang for the buck” value that it’s probably a glitch in the matrix. Whenever I have clients that are a bit adventurous, but not too handy, this is the step I recommend. If you’re just painting the interior of a house you can probably do this yourself for around $500.00. Tack on fixtures like door handles, lights and cabinet pulls and this can really transform the look of your house on a meager budget.

Landscaping

First impressions are everything, and what screams “I have my life together” better than a well-manicured lawn? I don’t think you need to get too crazy with this either. So long as the grass is cut, branches are trimmed and your hasta plants aren’t dead I think you’ll be fine. Mulch goes a real long way too. I myself don’t have much of a green thumb… that’s why I have rock in my flower beds. Even I haven’t found a way to kill those yet.

“Legalize” Your Illegal Bedrooms

This is one of my favorite renovations. We’re starting to get a bit up there in the “spendy” category but I’ve never had a client lose money on this strategy. I do recommend you hire this one out, it takes some gnarly equipment to cut a hole in a basement wall. The cost to do this ranges between $2,500 – $3,500 but at a minimum you’re going to double your money by adding legal bedrooms. There is one caveat to this. The less bedrooms you have to start the better. If you currently have 2 bedrooms and you “legalize” a 3rd, you’re going to get the most value out of that. If you have 6 bedrooms already and “legalize” a 7th, you’re not going to get as much back for that 7th bedroom. Law of diminishing returns… or something like that.

Flooring

New carpet, tile and flooring go a LONG way to improve the feel of your home. This is another one of those categories where it’s a bit “spendy” though. Laminate flooring is relatively easy to install with a few basic tools if you’re feeling handy. There are cost effective options on laminate flooring as well. Dingy carpets will definitely scare buyers away. At the very least you might be able to get away with cleaning them. If there too far gone, it’s best to replace them.

Kitchen and Bathrooms

Kitchen and bathroom updates. You didn’t think I was going to forget this one did you?!? What home renovations list would be complete without mentioning kitchens and bathrooms! I know you’ve heard this on HGTV a million times that “Kitchens and bathrooms sell the home” but it’s so true! Generally speaking this is about the most expensive thing you can do on this list. That doesn’t mean you can’t make a big visual impact on a meager budget though. Especially if you’re willing to roll up your sleeves.

I’ve got another disclaimer – I’m not a licensed contractor either, I’m just fairly handy. Here’s an example of a kitchen remodel we did last year on one of our places. It started out life as a builder basic 90’s Golden Oak special. We swapped out the counter tops, redid the back splash, painted the cabinets, removed some upper cabinets and added a shelf. All in on this we spent just a shade over $4,000.00 to achieve this look. Now, I know what you’re thinking – “Cody, I thought you said don’t pick any funky colors?? Those cabinets look like a John Deere Tractor?!?” Here’s what I have to say about that. This was designed to stand out because we use this property as an Airbnb and wanted it to attract attention. Best thing I can say is “Do as I say, not as I do”.

I Feel A Conclusion Brewing…

To sum things up, unless you live in a brand new house it’s likely that you’re leaving some meat on the bone in the form of equity. There are lots of ways you can increase the value of your home. Some are listed above, there are still others I didn’t mention. And here’s the tricky part, even if you’re looking to sell soon sometimes it doesn’t make sense to do those renovations, but sometimes it does. That depends on a lot of things like your budget, motivations for selling, timeline etc… Frankly, that’s a discussion for another article.

If you’re curious to know what your home is valued at and whether it’s worth it to spruce it up or leave well enough alone, feel free to reach out to either of us. We would love to be of assistance.

-Cody & Jos-

Real Home Value Vs Zillow’s “Zestimate

Zillow knows what they’re doing, right??

Last week, Jos and I were showing properties to one of our clients and we came across one that she was very interested in. It checked all the boxes. Nice neighborhood, plenty of space, HOA to take care of lawn and snow and most importantly at a price she could afford as a single mother. Ultimately she decided she wanted to write up an offer. After we gave her our estimated home value & offer amount she was a bit perplexed… She said “But the Zestimate on this is only 171,000”.

As Realtors, we know that Zillow’s “Zestimate” is generally speaking somewhere in the ballpark, but not the end all be all of home values. If I’m speaking Mandarin to you, let me break it down. Zillow is probably the premier website for home searches that the general public is aware of. They have what’s called a “Zestimate” for most homes. This is their proprietary algorithm that they use to derive an “estimated home value” of a given property.

For the record, our CMA or “Comparative Market Analysis” on this particular property came in right around the $205,000 mark. It’s not like this property was in some super unique neighborhood. We didn’t have to make a ton of adjustments to derive a value. This home was a townhome located in a neighborhood with 40 or so identical townhomes with recent sales to support value. As far as CMA’s go, this one was a “lay up”!

The Plot Thickens…

Too add some fuel to the fire of the “Zestimate” inaccuracies, I want to give you a brief history lesson. Back in April of 2018, Zillow launched a program called “Zillow offers” where Zillow would offer to buy your home. This programs was launched in 24 markets around the country. Mostly larger metropolitan areas like Los Angeles, Cincinnati, Orlando, Phoenix and places like that. They would use their “Zestimate” as the basis for what kind of price to pay for these homes that they purchased.

Their end goal was to buy properties quickly for a discount, do an HGTV style remodel on them then turn around and sell them back to the general public. Just in case you haven’t been paying attention to home values going back to 2018 you should know that home values nationally have increased quite a bit since that time. I’ll explain why that’s important in just a minute.

The Plot Thickens… but more this time….

Fast forward to 2021 and Zillow’s home purchasing program has ran aground. Their total 2021 losses in Zillow’s home flipping venture amounted to $881,000,000.00. That’s nearly a billion dollars, with a “B”. Meanwhile, if you were a home owner during the late 2020 to late 2021 time frame you probably saw a home value increase of around 17.5%. These are national figures, so each market is going to be a bit different. I don’t want to make the same mistake that Zillow did lol… Long story short, Zillow managed to lose money flipping homes in a rising market utilizing their “Zestimate” as the basis for purchasing these homes.

Adding insult to injury, Zillow decided to terminate their “Zillow Offers” program. They still had a bunch of houses in inventory. 8800 homes as of February 2022. What’s worse is they intend to sell those homes to big Hedge funds and Wall Street types. Likely removing those properties from the market for the long term as corporately held rental properties. To read more on why I think that’s not good for the general public, click here.

You’re telling me the internet can’t solve all my problems?!?

If your telling yourself “I thought Zillow had their poop in a group, how will I ever determine the value of my home now?!?!” don’t you worry. I’ve got a very simple and cost effective solution for you.

Talk to your friendly neighborhood Realtor.

As Realtors we are actively involved in the market on a daily basis. We see all kinds of homes in varying conditions, locations and price points. This gives us a back log of knowledge to fall back on when determining any particular homes value.

Time to unplug and talk to a human

Some of the things we’re looking at are location, condition, amenities, upgrades, bedroom count, bathroom count, square footage and most importantly, comparable sales data. The more recent that sales data the better. We’re currently in an up trending market. Meaning if a home sold a year ago for 200k then it should sell for more today. This is assuming all the other variables are the same. The tricky part is when the variables change, which I will admit is more often than not. That’s why it’s important to work with someone that has experience in this arena.

We can’t speak for all Realtors, but this is a service we provide for free. If you’re simply trying to determine a homes value we’re happy to determine that value for you. We’re just hopeful that when the time comes to sell you remember who helped you out (hint hint, nudge nudge).

I hope that this article has armed you with a little bit of knowledge on why your “Zestimate” might be a bit off or WAY off. I will admit that they do sometimes get it pretty close. More often then not though, they usually need some adjustment.

If you’re curious to know what your homes value is or how far off your “Zestimate” is, feel free to reach out to either of us. We’d love the opportunity to assist you.

-Cody & Jos-

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link